Life Settlement Infographic

The birth of a new asset class

What is a life settlement?

When a policyholder sells a life insurance policy that's no longer wanted, no longer needed, or no longer affordable. The owner gets a cash payment that exceeds the policy’s surrender value offered by the insurance carrier and has no on-going responsibility to pay future premiums. The buyer typically holds the policy until maturity (death of insured) and receives the benefit payable from the insurance company.

Life settlements are on their way to being a mainstream financial option...

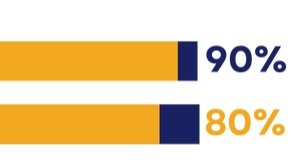

90% of life insurance policies (by face amount) that are terminated are either lapsed or surrendered.(2)

80% of the holders of the lapsed policies receive nothing in return even after years of premium payments.

Growth of the mark = Investment Opportunity

$170B net market potential in 2019-2028.(3)

Market growth fueled by the aging U.S. baby boomer population that's turning to life settlements for income to pay for retirement and long-term care.

The case for life settlement investing

Low Volatility + Diversificaiton

An investment in life settlements offers an excellent way to diversify any portfolio and serves asa great defensive strategy since the return is generally not affected by traditional factors, stock market volatility, or interest rate fluctuations.

Strong risk adjusted returns

With stock market valuations near record levels and real bond yields below zero, the central premise of life settlements — an asset class capable of producing double-digit annual returns with low correlation to traditional financial investments — is more relevant and appealing than ever.

“When comparing traditional asset classes against the AA Partners Life Settlement Index, it is clear that life settlements have a near zero correlation to the returns of mainstream financial markets.”

A socially responsible investment

Investing in life settlements is a meaningful way to support the physical and financial wellbeing of U.S. senior citizens as they seek support for retirement or medical expenses. This is especially true for those who hold smaller-face value policies as they are more financially vulnerable.

Additionally, life settlement proceeds may ease the burden on adult children who contribute to caring for an aging parent and taxpayer-funded entitlement programs, like Medicare and Medicaid.

A meaningful investment: life settlements

The life settlement asset class provides investors a way to make a positive, tangible impact on society. Here, we explain how life settlement investments positively impact senior citizens by providing needed liquidity using real world examples.

AIR Asset Management’s longevity-based strategy

Want to learn more about AIR Asset Management’s approach to investing in the life settlement market? Request more materials from our team.