Allocating to Life Settlements & Private Debt

As more and more advisors come to understand the compelling investment case for dedicating a portion of client portfolios to life settlements (the short answer: double-digit targeted returns that are largely uncorrelated with financial markets at a time when many investors are looking to diversify), the inevitable next question is where those assets fit in a portfolio allocation framework. Previously the exclusive province of large institutions, life settlements are increasingly accessible to qualified individual investors. But for advisors to help their clients take advantage of these and other private debt opportunities, they first need to understand how to characterize them in the context of a financial plan.

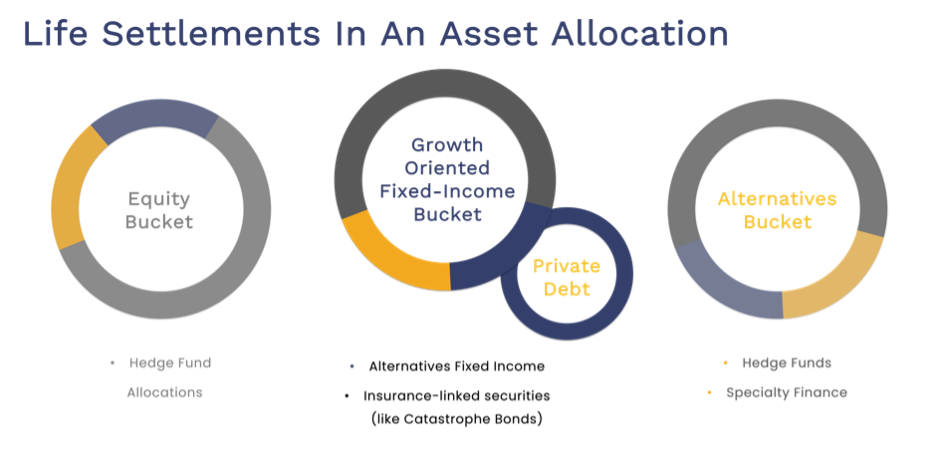

Practices vary, with some financial planners placing life settlement investments into a “general alternatives,” or “alternative fixed income” bucket, or even a hedge fund allocation, while others assign them to the insurance linked securities sleeve that might also include catastrophe bonds. That may make sense in some contexts, but because of their return profile and because the underlying policies are a contractual repayment obligation, life settlements are most accurately characterized as private credit. Private credit is defined by Cambridge Associates as a sub-category of private debt that excludes investment-grade and high-yield bonds. Alternative investments like life settlements may address the inefficiencies of traditional investments (such as high volatility, benchmarking, etc.). Therefore, they fit outside or in between traditional allocations.

Understanding why life settlement investments best fit into the private credit allocation can help advisors and their clients better understand the unique and compelling characteristics of these assets and is worth exploring in greater detail.

The growing popularity of private debt

As it turns out, advisors allocating to private debt are in some illustrious company. It has always been a compelling portfolio diversification investment, but the category’s popularity exploded when institutional investors moved to fill the void after traditional lenders were squeezed out of the market by restrictive banking regulations put in place after the credit crisis. According to Preqin, the private debt market has more than doubled to more than $812 billion globally over the last decade.

This increased demand is attributed to falling returns on offer from traditional fixed-income products such as government bonds and the more recent view that traditional corporate credit investments may be overbought.

The rotation into private debt shows little sign of slowing down and appears especially robust in one especially hot corner of the market, private credit. Some 98% of institutional investors recently told Preqin they plan to maintain or increase their allocation to private credit, a sub-class of private debt that includes distressed credit, mezzanine investing, direct lending, and specialty finance.

With so much capital flowing into private debt, it’s fair to ask whether a bubble might be forming. The more correlated segments of the category, which are seen to be more vulnerable to economic shocks and market dislocations, are especially concerning. If public markets undergo a major correction, individual investors and their advisors who are allocating to the strategies or contemplating an allocation would do well to ask whether the private debt and private credit strategies they are considering might follow suit and whether additional diversification within the private debt category might be prudent?

Disparate correlations within private debt and private credit

Private credit allocations are typically meant to serve as a portfolio diversifier by reducing correlation to traditional investments, but not all of the strategies within the sub-class deliver the same level of non-correlation.

Even in “normal markets,” many private credit assets exhibit correlation because spreads on public debt from comparable companies are often used as a basis by which to value the private credit. But when markets gap, correlations can increase even further because many private credit strategies such as mezzanine finance, direct loans, and distressed credit rely on healthy capital markets to achieve a favorable exit. Mezzanine and direct lending, for example, may suffer when credit markets shut down and issuers’ access to refinancing is blocked. And in the distressed market, sharp economic downturns can force fire-sale chapter 7 liquidations where creditors receive cents-on-the-dollar instead of equity in a going concern that they might have received in a chapter 11 bankruptcy scenario.

Nobody minds correlation when all markets are going up. But if investors made allocations into private debt and private credit strategies to soften the impact of market downturns, they may be in for a rude awakening if their specific investments are more correlated than expected when markets inevitably go down.

Enter specialty finance and life settlements

The specialty finance area of private credit, which includes life settlements, litigation finance, healthcare royalties, catastrophe bonds, structured settlements, and aviation finance, is a bit different. Their cashflows may be linked to non-market events – for example, the popularity over time of a movie or music catalog or an act of God like a hurricane season or an earthquake. Also, the assets may be “self-liquidating” and, thus, not reliant on healthy capital markets for an exit.

Life settlements exemplify both features to the hilt, as mortality is not generally correlated to financial markets and liquidity is typically achieved when death benefits are paid out for the underlying policies. (Some life settlement managers may elect to sell certain policies before they mature in a trading strategy, but ultimately that is not required to achieve liquidity.)

No asset in the specialty finance space – or any other investment space that has a secondary market for liquidity is completely uncorrelated to the broader markets due to simple supply and demand factors. Life settlements are no exception. But traditional financial markets risks – credit exposure – are de minimis in the context of the expected 13+% internal rate of return. The far bigger components of risk/drivers of returns in life settlements – getting mortality rates wrong or regulatory issues – have little connection to financial markets and can be effectively controlled by a skillful and experienced manager.

Conclusion

The risk/reward profile of the traditional 60/40 portfolio is declining, making the need for diversification and managing risk increasingly important. As private debt continues to extend beyond institutional investors, wealth advisors and financial advisors will be instrumental in helping investors understand the benefits of incorporating private debt into their portfolios. But as outlined above, not all private debt assets are created equal. Life settlement investing has historically delivered compelling returns with low correlations, giving them the ability to fill the gaps between traditional allocations. Educating investors on the return drivers and risk anatomy of life settlement investments will support the decision to enhance traditional allocations, perhaps most appropriately in the private credit bucket.