Our Approach to Responsible Investing

Sustainable investing has different meanings to managers across the asset management industry. Therefore, we firmly believe investors seeking to diversify their portfolios with responsible investments require more than a one-size-fits-all approach that doesn't compromise their returns. We take a pragmatic and flexible approach when evaluating and sourcing sustainable considerations in our investment process.

“AIR Asset Management is committed to a culture that recognizes the value of responsible investing and views implementing policies incorporating sustainable considerations as an extension of our core business philosophy.”

Richard Beleutz, Founder & CEO

A Meaningful Investment: Life Settlements

Investors are drawn to life settlement investing for its demonstrated ability to produce uncorrelated, strong returns. However, the asset class also provides investors a way to positively impact senior citizens' lives by providing them with much-needed liquidity. Watch our video to learn how.

UN Principals for Responsible Investment

AIR Asset Management became a signatory to the Principles for Responsible Investment (PRI) in October 2019. As a signatory, we recognize that applying PRI’s principles to our investment philosophy better aligns our investors with society’s broader objectives as articulated by the UN Sustainable Development Goals (SDGs).

Meet our Responsible Investment Committee

Our Responsible Investment Committee, comprised of individuals across the firm and chaired by our Chief Investment Officer, manages our corporate citizenship efforts, sets strategic direction, and coordinates our actions globally as it relates to responsible investing, diversity and inclusion, and community involvement.

Steve Luongo

Chief Investment Officer

Taylor Garvey

Senior Director of Marketing

Carmel Wasemiller

Senior Director of Finance

Alex Ochoa

Senior Business Development Associate

Related Insights

Life Settlements: A Socially Responsible Investment

Investors are drawn to life settlement investing for its demonstrated ability to produce uncorrelated, strong returns. However, the asset class also provides investors a way to make a positive, tangible impact on society. Here, we explain how life settlement investments positively impact senior citizens by providing needed liquidity.

Committed to Diversity & Inclusion

Our Firm is made up of individuals from different backgrounds, cultures, and experiences. We celebrate inclusion and embrace many perspectives to solve complex problems, generate great ideas, and drive value.

Fostering Inclusion

Employee inclusion networks, educational programs, and professional coaching, which are open to all professionals at AIR Asset Management, support our firm’s diversity and inclusion strategy.

Program & Partnership Highlights

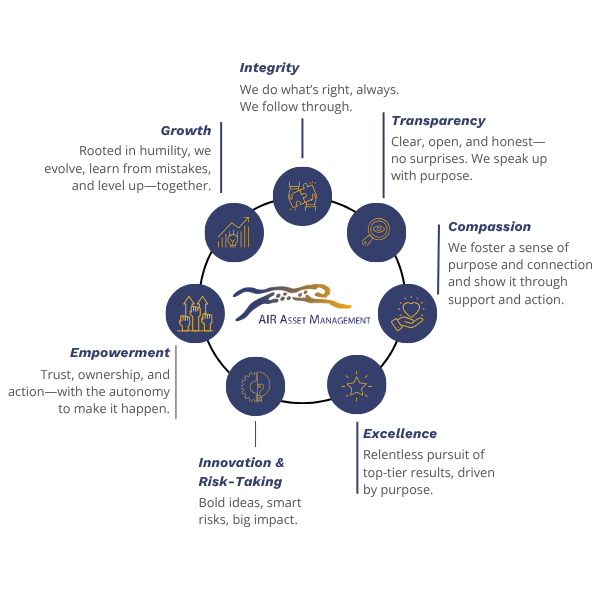

Our Values

Our values don’t stand alone—they fuel each other. Integrity builds trust for empowerment. Transparency enables innovation. Compassion strengthens growth. Together, they define who we are and how we win.

Focus on Environmental Sustainability

We believe we have a responsibility to leave the world a better place for future generations. Our approach to environmental sustainability focuses on measurable operational interventions to reduce resource usage. Despite our investments having little to no environmental impact, our business activities and operations do.

Environmental Stewardship

Our commitment to environmental stewardship and mitigating long-term climate change is evident in our business operations. Within our office, we recycle waste, select energy-efficient products where practical, and discourage unnecessary business travel.

Since 2020, we have conducted annual greenhouse gas (GHG) emissions assessments through a comprehensive Greenhouse Gas report. These assessments follow the GHG Protocol Corporate Accounting and Reporting Standards, recognized and endorsed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD). Our assessments have consistently confirmed our relatively low-carbon usage and provided valuable insights into areas where we can further reduce our emission footprint.

Furthermore, as part of our commitment to offsetting carbon usage, we annually purchase Gold Standard Carbon Credits. These credits are verified emission reductions (VERs), contributing to a safer climate and a more sustainable world. By investing in these credits, we actively work towards our goal of becoming a carbon-neutral organization.

AIR Asset Management Supports Global Best Practices

We engage with multiple organizations that are committed to enhancing the integration of ESG factors and driving greater industry transparency. As a signatory of the PRI, we proudly support the Task Force on Climate-Related Finance Disclosures (TCFD), the Paris Agreement, and the Greenhouse Gas Protocol measures. These organizations are focused on furthering the development of low carbon practices and creating voluntary, consistent climate-related company reporting.

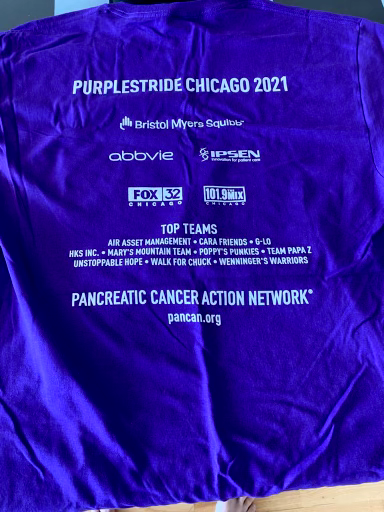

Investing in our Communities

At AIR Asset Management, supporting causes near and dear to our team members’ hearts is of utmost importance to our Firm. We greatly enjoy giving back to our communities through charitable donations, employee volunteers, or participating in non-profit events.

We are proud to offer our employees a Charitable Giving Program designed to amplify their charitable endeavors through the following three meaningful ways: Matching 1:1, Dollars for Doers, and Support for Non-profit Run/Walk/Ride Events.