How Life Settlement Investments Enhance Financial Security and Quality of Life

Life settlements not only present a compelling opportunity for investors but also offer substantial financial relief to life insurance policyholders. By choosing to invest in life settlements, individuals and institutions can participate in a socially responsible investment that yields returns while simultaneously making a positive impact on the lives of seniors.

For consumers, particularly seniors, life settlements transform an underutilized asset into a source of substantial financial support. Life insurance is often a senior citizen’s largest asset and can be used to alleviate financial challenges, but they rarely treat it that way. The increased liquidity from a life settlement can significantly improve their quality of life, offering them the means to afford quality healthcare, comfortable living arrangements, and the peace of mind that comes with financial stability.

The case studies presented in this article underscore the tangible benefits life settlements provide to policy owners.

CASE STUDY 1: Paying for Senior Care

$132,500 For Wife’s Senior Care Needs

A husband needs to move his wife into a senior care facility but wondered how he could afford quality accommodations. He met with his attorney, who recommended converting his wife’s $275,000 Universal life insurance policy into a Senior Care Benefit Plan to offset care costs. A reputable life settlement provider was able to obtain a $132,500 offer on her policy placed into a plan, which made monthly payments of $3,000 toward her care.

CASE STUDY 2: Assistance with Daily Living & Medical Expenses

$200,000 For Medical Treatments

A 72 year-old male owned an $896,450 Universal life policy and had hypertensive heart disease, cerebrovascular/carotid artery disease, and a neurocognitive disorder. He could no longer afford the premiums and was frustrated watching the cash surrender value decrease each month. He received a settlement offer of $200,000, more than twice the cash surrender value and a meaningful amount of money to help with his daily living and medical expenses.

CASE STUDY 3: Alleviating the Premium

$180,000 Shared Among Family’s Children

In this case of one family, four adult children owned a $1,000,000 life insurance policy on their 74 year-old mother. The policy had no cash surrender value and would lapse if a premium of $33,300 wasn’t paid. The family didn’t want to pay the premium, but they also didn’t want to lose the investment of all those premium payments they made since they took out the policy in 1995. Their financial advisor suggested selling the policy. A life settlement provider helped them get an offer of $180,000 for the policy, and each owner got $45,000 while alleviating the premium burden.

Case Study 4: Transformative Relief

$320,000 from Policy Amidst Health Crisis

A 59 year-old male with a $500,000 Term Life policy was diagnosed with pancreatic cancer. Unfortunately, due to the extra expenses his devastating illness caused, he couldn't afford to convert his policy. His advisor suggested investigating the availability of a viatical life settlement. In this tragic circumstance, he received $320,000, a life-changing amount for this man and his family.

Life Settlements Provide Financial Opportunities

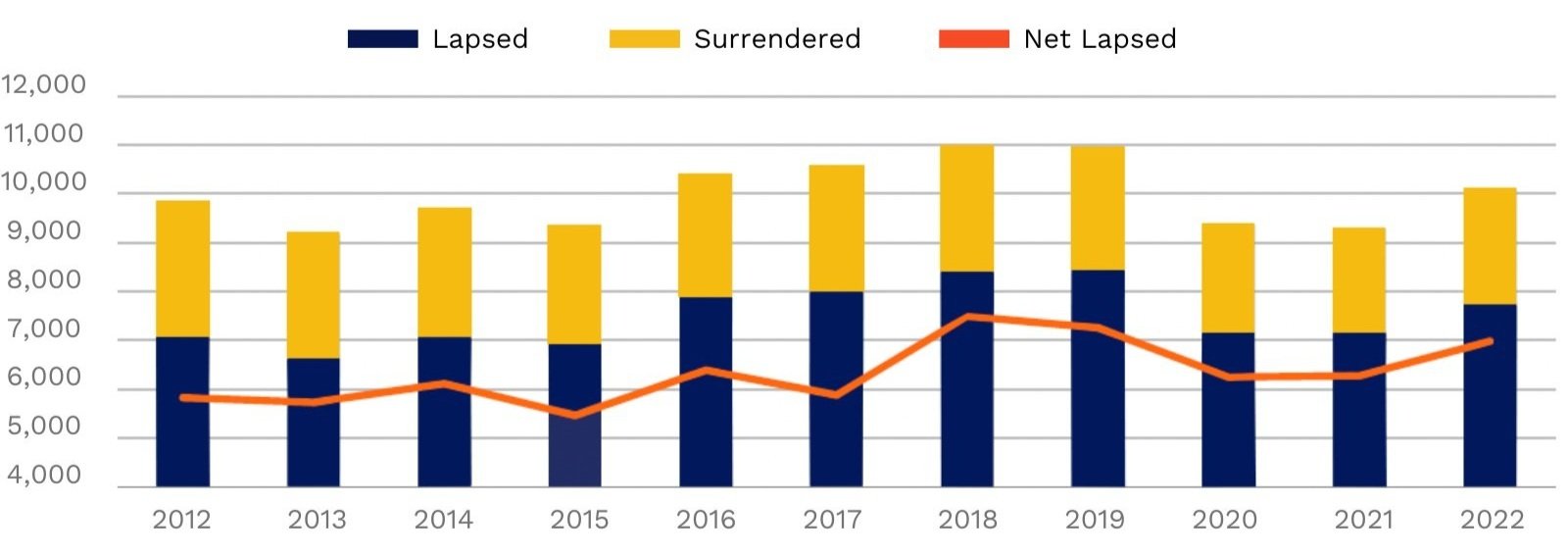

It's important to recognize that almost 85% life insurance policies do not result in a death benefit payout.* The main reason for this is that numerous policyholders outlive their policy's term, leading to its expiration without any claim being made, or they choose to give up their policies prematurely before any insured event takes place. Consequently, the premiums paid by these policyholders often fail to yield any significant financial benefits.

Life Insurance Policies Lapsed or Surrendered Each Year

In Thousands

© 2023 Conning, Inc. (“Conning”)

It's estimated that over $200 billion worth of life insurance policies will be surrendered or lapsed annually through 2027. Life settlements offer an alternative for policyholders considering letting their policies lapse or surrendering them. The data presented in the associated chart reveals an uptick in the number of policies that were allowed to lapse, climbing from 7.1 million in 2021 to 7.7 million in 2022. If even a fraction of these policies were settled, it could represent substantial capital reallocated from dormant policies to active, life-enhancing purposes. For investors, this represents an untapped potential for growth and societal impact.

According to the Life Insurance Settlement Association’s 2023 Market Data, consumers received over five times more than their Cash Surrender Values (CSV), translating into almost $640M more for American seniors than what they would have received from insurance carriers.

Life Settlements: A Win-Win Investment Strategy for Consumers and Investors

Life settlements are more than just a financial instrument; they are a means of fostering a more financially secure and compassionate society. By investing in life settlements, investors not only position themselves to benefit from potentially attractive risk-adjusted returns (Read: Whether Volatility is High or Low, Life Settlement Strategies Perform) but also become part of a solution that supports our seniors when they need it the most.

Sources:

Case Study 1 -5 Source: Q Life Settlements

Chart 1, Lapsed & Surrendered Data: Conning, Inc.

Disclaimers

General: The information and any disclosures provided in this article are in summary form and prepared solely for informational purposes. This document does not constitute an offer for interests in any investment fund managed or advised by AIR Asset Management ("AIRAM"). An offering AIRAM Funds will be made only by a definitive confidential private offering memorandum and only in those jurisdictions where permitted by law. Any actions made by you based on the information and any disclosures not contained in or consistent with the Funds' confidential private offering memorandum will be solely at your own risk.